Well, here’s a classic one from the “listen to your own advice” files.

I jumped into EUR/GBP trades earlier this year, thinking I was being clever. Instead, I walked face-first into a wall of obvious mistakes.

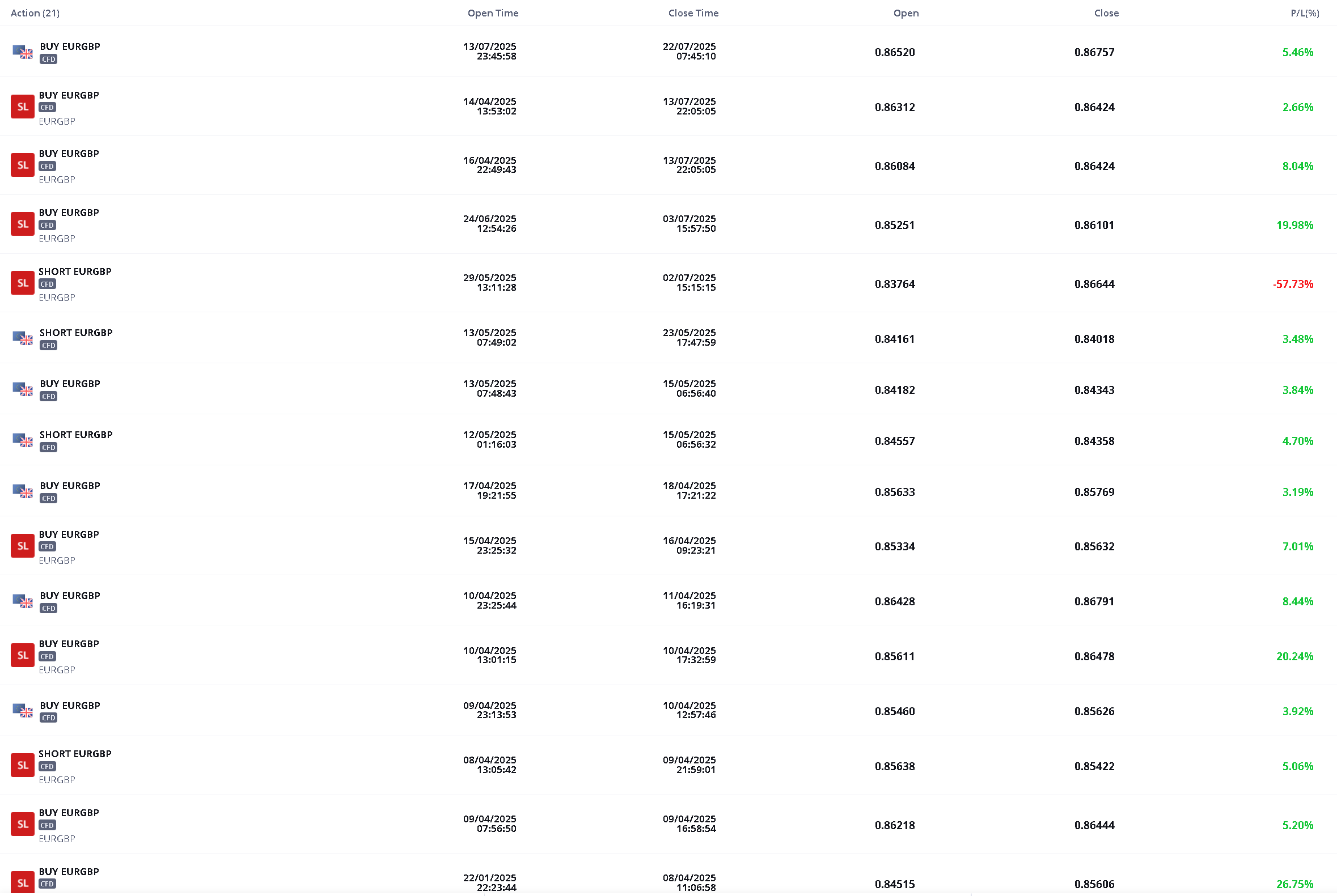

Take a look at the screenshot below. Yep, that big red number is me blowing up a short position because I didn’t set a realistic stop loss and decided to go against the trend. Spoiler: the market didn’t care about my trade, it carried on without me, and I paid for the privilege of being stubborn.

Mistake #1: Unrealistic Stop Loss

Instead of placing a proper stop that would protect me from outsized losses, I set one so far away it might as well not have existed. When the market moved against me, I just sat there watching, hoping it would turn around. It didn’t.

Mistake #2: Fighting the Trend

EUR/GBP was moving in one direction, and I decided I knew better. “It’ll dip, I’ll grab quick profits, then close.” Famous last words. Fighting momentum is just a fancy way of donating money to the market.

The Saving Grace

This all sounds grim, but here’s the key part: I only risked less than 1% of my total portfolio on these trades. Painful lesson, yes. Catastrophic? No.

Eejit Thoughts

Losses sting, but they teach. I took the time to review what went wrong. Even on winning trades, I spotted hesitation and late entries.

Stop losses are important, and I didn’t manage mine properly. Honestly, there was no real plan. It was a hit-and-hope job. For context, 15 out of 16 trades closed in profit. That 1 loser dragged my P/L percentage down to 1.98%. What made it worse? I must have moved the stop loss. It defaults to 50%, so I sabotaged myself by fiddling with it.

Going against the trend is dangerous. Sure, markets don’t move in straight lines, but if you miss the little dips, those “small shorts” become big losses fast. Price had bounced off the 50MA and was closing above it consistently on the daily chart. RSI around 52 was another clue it wasn’t ready to roll over. The signs were there, I just ignored them.

Takeaways

Set stop losses you’ll actually respect.

Don’t fight the trend just because your gut says so.

Keep position sizes small enough that when you do mess up (and you will), it doesn’t ruin your portfolio.

I’ll keep making mistakes so you don’t have to. But if you do, at least make sure they’re cheap mistakes.

So, be honest — do you always follow your strategy? Or do you have your own “listen to your own advice” moments?

Leave a Reply