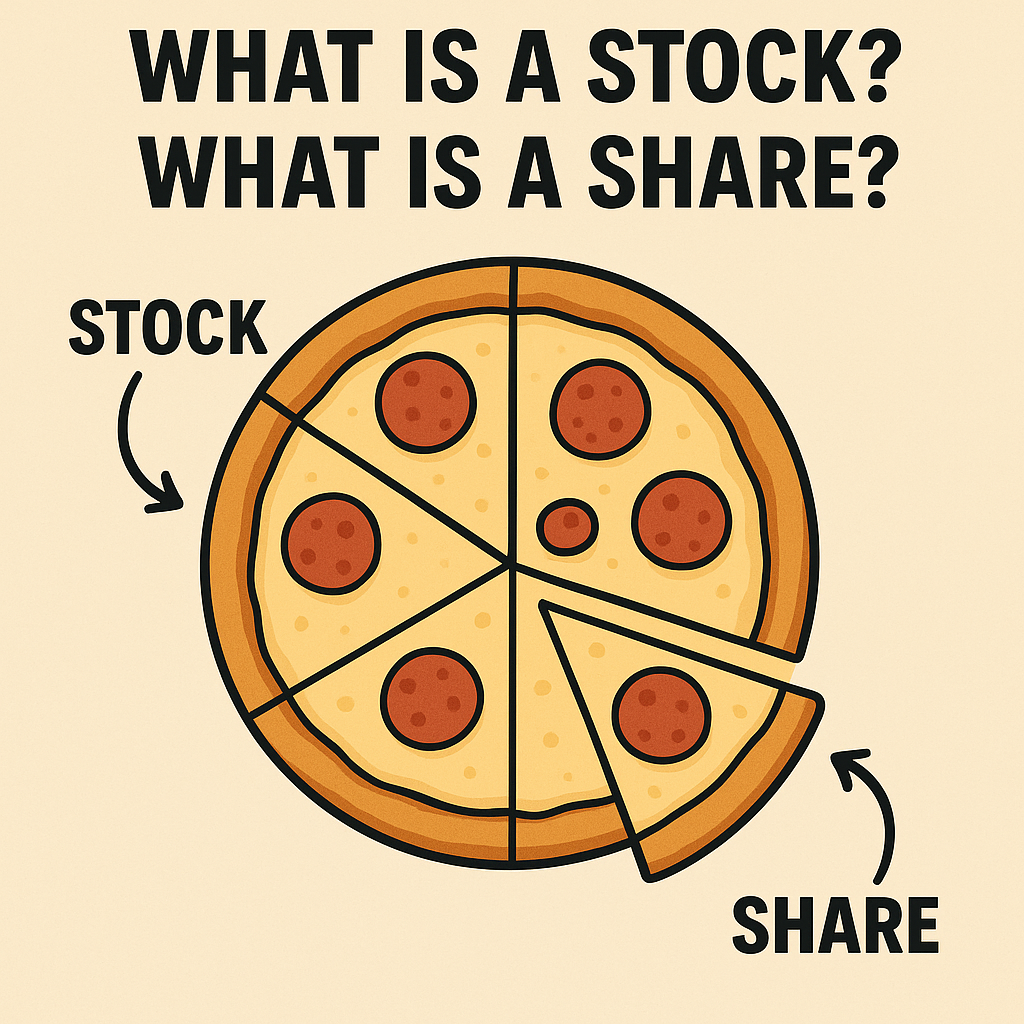

If you’ve ever heard someone talk about stocks, shares, or shorting and felt totally lost — don’t worry, you’re not alone. This guide breaks it all down using pizza (yes, pizza) to explain it simply.

(And yes, I’m writing this because my partner said she didn’t understand my last post — and she’s absolutely right. As much as it pains me to admit she is right.)

What is a Stock?

A stock represents ownership in a company. If someone says they “own stocks,” it usually means they’ve invested in several different companies by buying a piece (or share) of each.

A ticker (or stock ticker) is a unique identifier for a publicly traded company on a stock exchange.

GOOG or GOOGL = Alphabet Inc. (Google’s parent company)

AAPL = Apple Inc.

TSLA = Tesla, Inc.

In analogy terms, the stock is the whole pizza.

What is a Share?

A share is a unit of stock. The stock may be divided into different portions. Imagine a pizza being divided in 10 slices and you own 6 of them (difficult to do in my household!). You then own 60% of the pizza (60% of the company). That would mean you have the majority share. Typically in companies, that might mean that major decisions are controlled by the majority share holder. In pizza terms, the majority shareholder decides the toppings.

Example: If a company has 1,000 shares and you own 10, you own 1% of the company.

When profits are made, the company may decide to share it with shareholders. This is called dividends. Not all companies pay out dividends. This is like getting extra toppings or sauce on the pizza for free.

Companies might issue shares to help fund a new project or expand for example. They are trying to raise money. Shareholders take part of the risk but can also be in a position to get a higher reward.

Example: A company has a successful product and is looking to produce a successor product but lacks the funds to do so. The company issues shares to raise money. The shares are bought by investors and the project goes ahead. The new product is successful. More people become interested in owning the shares and the share price goes up.

Pizza Example: I make a cheese pizza (the stock) and cut it into 8 slices. I want to then make a pepperoni pizza but I am low on cash. Instead of taking a loan (expensive pizza, I know!) from the bank, I sell you 2 slices of pizza and sell 2 slices to someone else. The pepperoni pizza is a massive hit and you share in the success while I’ve managed to make another pizza and expanded. Later down the line, I offer to buy back the 2 slices I sold you. I own more shares again which tends to value of each share up. I then eat the 2 slices which is like removing the shares. There are now less shares available and I have greater ownership.

What is a Broker?

A broker is a middleman who helps you buy or sell stocks. This can be a human like a financial advisor or an online broker such as Etoro and Trading212. These are platforms that you can buy and sell stocks. Some brokers are only available in certain countries.

I have personally been using Etoro. You will find people hate it if they are losing money and it is okay if they are making money! I find it easy to use which is what we are all about at Eejit’s Guide. Simple to setup and get started. The user interface is easy and clear.

Here’s a good video from the Etoro channel explaining the setup:

Buying and Shorting

Buying (going long) is the normal way of investing. We buy shares, hoping that the value will go up. We then sell it at the higher price to make profit.

Example: We buy a stock at $10 and it goes up in value to $12. We then sell it to make a profit of $2.

Shorting is the opposite. This is borrowing shares and selling it straight away. You are expecting the value to go lower and then buy it back at the lower price. You then keep the difference as profit.

Example: We short a stock (borrow) at $10 and it goes down in value to $6. We then buy it back at $6 and it gets returned at the $10 to make a profit of $4.

There is usually higher fees involved with shorting and it is riskier. If we buy a stock, the most we can lose is 100% if the company liquidated for example. If we short a stock and the price rises, potentially the losses are unlimited if we don’t have a stop loss.

Pizza Example:

Buying: You buy a pizza slice for $2, hoping to sell it for $4.

Shorting: You borrow a slice and sell it for $2, hoping to buy it back later for $1.

Putting That All Together

It is quite simple to get started. If you want to invest in stocks but not looking to invest in certain stocks then having an investment account where it is managed for you might be the best option. If you want to do the investing yourself then open up a brokerage account. Deposit money which is usually a minimum limit (£200 for example) and then you can buy and sell, track your investments and report on the profits and losses.

It is really easy to get it all setup, knowing what to buy/sell and when is the difficult part. Last time I checked, on Etoro, 67% of retail traders lose money when trading. There are very real risks to investing on your own. Please keep it in mind! Part of the reason why I do it is to challenge myself and I enjoy it.

Ready to test your knowledge? Take this quick, anonymous quiz and see what you’ve learned:

Leave a Reply